In today’s Daily:

-

Buffett stays bullish on oil: Legendary investor adds to Occidental stake for nine straight days.

-

Nvidia passes Microsoft: Chipmaker becomes largest company by market cap.

-

Is Nvidia a buy today: Two MarketWise brands give their ratings of Nvidia’s shares after the long run up.

-

More from Chaikin: Chaikin Analytics’ Power Gauge turns bullish on another huge market darling.

Buffett is on an oil buying spree…

Early in 2022, Buffett’s Berkshire Hathaway placed a huge bet on American energy. The holding company built a $7 billion stake in Occidental Petroleum (OXY) in just two weeks – good for 14% of the total company. And he hasn’t stopped buying since…

Now, Berkshire has a nearly 29% stake in Occidental. And they’ve bought more shares on each of the past nine trading days, totaling about $40 million, according to SEC filings.

At a total value of more than $15 billion, Occidental is now Berkshire’s sixth-largest holding. It now only trails long-term holdings like American Express (AXP), Bank of America (BAC), and Coca-Cola (KO), as well as Apple (AAPL) and Chevron (CVX).

When Buffett makes a big bet, folks tend to listen. Right now, he’s betting big on U.S. energy. And Buffett rarely “trades” stocks. When he buys, he’s in for the long haul. That could be a good sign for energy stocks going forward.

There’s a new leader at the top…

Nvidia (NVDA) continues its tear higher. The stock jumped more than 3% today, bringing its total market cap to $3.3 trillion. That makes Nvidia the largest company in the U.S. by market cap – more than Microsoft (MSFT) and Apple (AAPL).

As we all know, Nvidia has been one of the biggest beneficiaries of the recent artificial intelligence (“AI”) bull market. The company’s chips are in high demand to run AI models, and as a result the stock has soared. It’s up more than 200% over the past year, and has surged nearly 3,500% over the past five years!

Thoughts on Nvidia today…

Looking backwards, and it’s easy to say that folks have missed out if they didn’t invest in Nvidia. But two of MarketWise’s brands still rate the stock highly today. You see, both Chaikin Analytics and TradeSmith have built proprietary systems to rate stocks.

Let’s start with Chaikin Analytics first…

Chaikin Analytics founder Marc Chaikin built his Power Gauge system as a way to rank stocks. His system looks at more than 20 different factors and combines them into one rating to indicate where the stock could be headed over the next one to six months.

It separates the stocks into five baskets: Very Bearish, Bearish, Neutral, Bullish, and Very Bullish. Right now, the Chaikin Power Gauge is “Very Bullish” on Nvidia. From the Power Gauge Summary…

The Chaikin Power Gauge Rating™ for NVDA is Very Bullish due to very strong earnings performance, very strong price/volume activity and very positive expert activity. The stock also has poor financial metrics.

NVDA’s earnings performance is very strong as a result of high earnings growth over the past 3-5 years and an upward yearly earnings trend.

Moving on to TradeSmith…

Like Chaikin Analytics, TradeSmith’s system rates stocks based on technical indicators and financial performance. TradeSmith’s rating shows Nvidia entered the “Green zone” for a buy way back in February 2023, and has remained there ever since.

TradeSmith also notes that the smart moving average has been in an uptrend since January, while giving Nvidia a Business Quality Score of 97 – both great signs Nvidia is still a buy. However, the system does warn that Nvidia shares are “high risk,” and recommends a wide stop loss of about 42%.

So there you have it. Nvidia’s stock has soared higher, and just because the world’s largest public company. But, when you look at two of the proprietary indicators from MarketWise’s Chaikin Analytics and TradeSmith brands, the stock is still in a great position today.

Chaikin’s read on another well-known stock…

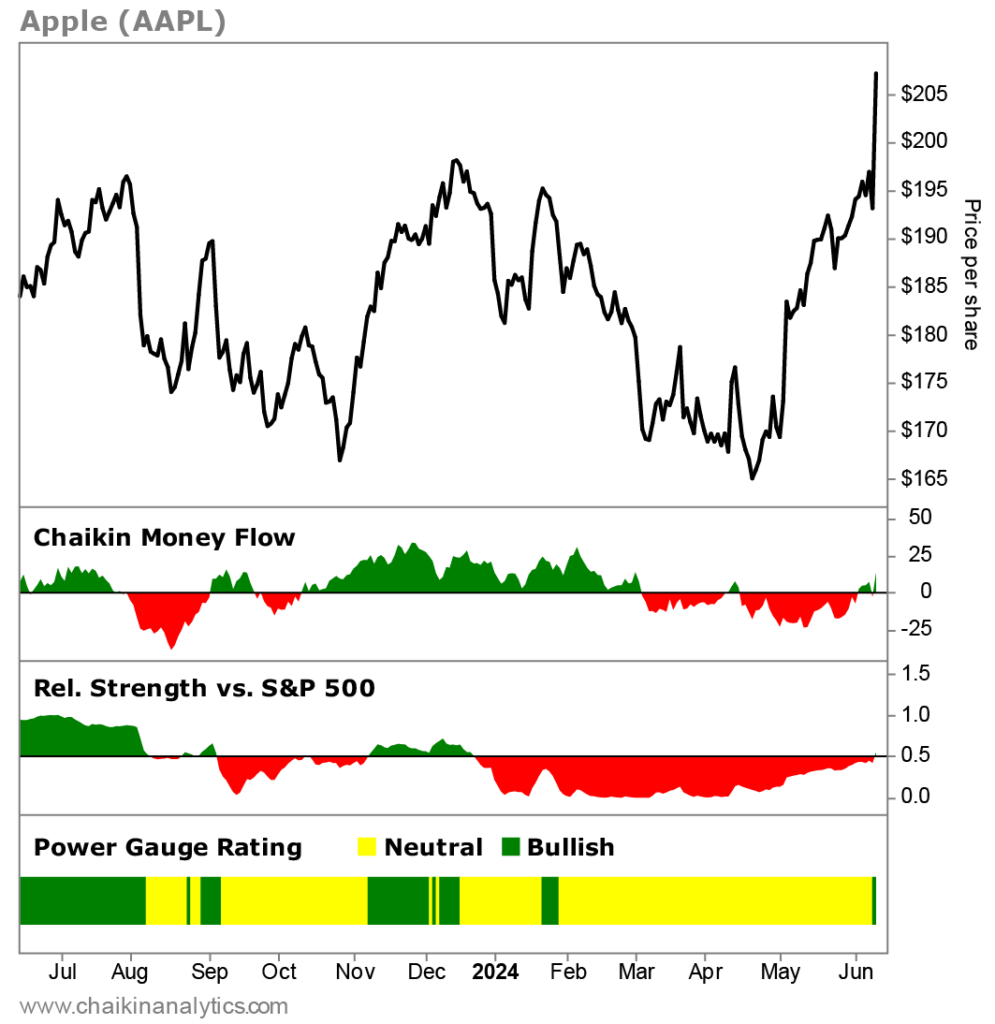

Nvidia isn’t the only megacap stock that Chaikin’s system has a bullish rating on. Last week, Apple delivered an update on what it’s doing in terms of artificial intelligence. Chaikin Analytics editorial director Vic Lederman took a look to see what the Power Gauge had to say on Apple.

In today’s MarketWise Daily, from the June 13 issue of the free Chaikin PowerFeed e-letter, Vic shows that the Power Gauge recently turned bullish on Apple after months of a sustained Neutral rating.

As Vic wrote…

As you can see, Apple just shifted into “bullish” territory for the first time since the start of the year. But you’ll also notice that it has struggled to maintain a “bullish” rating throughout most of the past 12 months.

And the Power Gauge makes it clear the company has some work to do.

If Apple can hold on to its bullish rating, it’s a good sign that the stock can make up some of the underperformance it’s experienced against the rest of the technology sector. Over to Vic…

The Power Gauge Perspective on Apple’s Big AI NewsBy Vic Lederman, editorial director, Chaikin Analytics Apple (AAPL) just turned heads with a major new announcement… You see, the tech titan just kicked off its annual Worldwide Developers Conference this week. And this year’s focus wasn’t surprising in the least. Apple zeroed in on artificial intelligence (“AI”). Or as the company prefers to call it – Apple Intelligence. Seriously. According to the company, Apple Intelligence is coming to its iOS operating system “soon.” And it’s supposed to deliver on nearly all the promises that Apple originally made with the Siri voice assistant. In other words, Apple Intelligence will let Siri become the virtual assistant it was meant to be. That means retrieving information across multiple apps, doing tasks, and more. Most interestingly, Apple has announced a partnership with OpenAI. As you likely know, that’s the tech company that created the hit AI chatbot ChatGPT. With this partnership, Siri will have access to ChatGPT. And Apple says that users with paid ChatGPT accounts will be able to access those features through Siri. Apple also says that it will eventually connect with other so-called “large language models,” which is the AI tech behind ChatGPT. This all sounds pretty grand. But there’s no question that Apple made this announcement knowing that Wall Street would be watching. Given the big news, you would likely assume that AAPL shares would be set to soar in the weeks and months ahead in response. So today, let’s take a deeper look and see what the Power Gauge has to say about the stock… Apple’s main event at the conference had the polish you’d expect. And the company is trying its best to sell these new AI features as something amazing. But folks, Apple is still facing some hard realities. Many of the features it has announced are ones that Alphabet’s (GOOGL) Google already built into its mobile operating system… years ago. And the others are of the “someday we’ll figure this out” variety. Now, to be fair to Apple, that’s the point of its annual developers’ conference. The idea is to get third-party developers excited about the tools in iOS. Still, it feels like Apple is playing catch-up. And that shows in its share price, too. Let’s start with a one-year chart of the stock with some data from the Power Gauge…

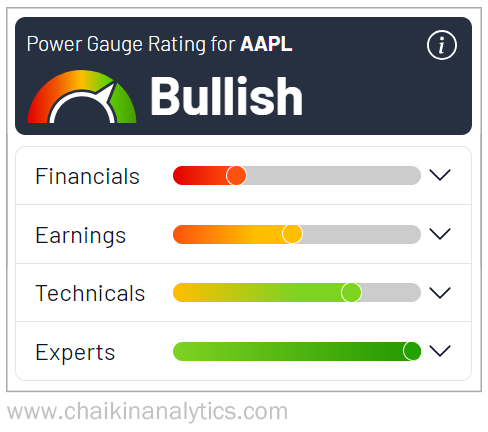

As you can see, Apple’s stock largely traded sideways for most of 2024. But in the wake of the AI announcement, AAPL shares spiked higher earlier this week. They’re now up about 11% this year. Meanwhile, the tech-heavy Nasdaq 100 Index is up about 16% year to date. And the broad market S&P 500 Index has posted a roughly 14% gain over the same time frame. Put simply, Apple is still trailing the market’s big move higher this year. Could the Apple Intelligence announcement be the start of a turnaround? Sure… and we’re seeing what could be the very beginning of that. Take a look at the bottom panel below the price chart… That’s our Power Gauge rating. It looks at more than 20 distinct factors – everything from financials, to technicals, to expert analysis. And it distills it all down into a single rating. These range from “very bearish” to “very bullish.” As you can see, Apple just shifted into “bullish” territory for the first time since the start of the year. But you’ll also notice that it has struggled to maintain a “bullish” rating throughout most of the past 12 months. And the Power Gauge makes it clear the company has some work to do. Take a look at this screenshot from our system…

The recent move to “bullish” territory is driven by improvements in the Experts and Technicals categories. But as you can see, the company has a lot of room for improvement in the Financials and Earnings categories that the Power Gauge rates. So, Apple spoke. The company said it was committing to AI. And Wall Street listened. Now, Apple needs to deliver results that directly contribute to growth. And we’ll have to see if that’s enough to maintain a “bullish” rating – or even push the company into stronger territory in the Power Gauge. I’ll have my eye on the stock. |