In today’s Daily:

-

Boeing is hiring: Planemaker has had no luck looking for replacement CEO.

-

Fed disconnect: The market may be expecting too much action from the Federal Reserve this year.

-

Calm waters (for now): Volatility hits a five-year low, average daily market move is less than half of historical norm.

-

The end of low volatility: One MarketWise editor believes markets will get bumpier as we approach the election.

Boeing’s (BA) top job is up for grabs…

In March, current Boeing CEO Dave Calhoun said he would step down at the end of the year. The news of Calhoun’s departure came at a time when the company’s planes were under media scrutiny for several incidents with its planes.

According to a report from the Wall Street Journal, many of Boeing’s top choices have turned down the job. That includes GE CEO Larry Culp, multiple other aerospace executives, and even one of its own board members.

With everything the company faces, it’s easy to see why the candidates are staying in their current jobs.

MarketWise CEO Porter Stansberry first warned of Boeing’s issues in a report for Porter & Company Research last year.

And in January, he laid out several reasons why Boeing was headed for a “collapse.” Among them were Boeing’s huge debt load and a change to the company’s culture.

Porter’s warning was timely – the stock is down about 15% since he first published his report. And it’s down 21% since he posted his thoughts to the public at the start of the year.

But we wouldn’t recommend trying to time the bottom and buy shares here. The company still has a mountain of debt, and its planes are still under the microscope. In fact, current CEO Calhoun is set to testify before Congress about the safety of Boeing planes.

It’s going to take sine serious work to turn Boeing around. The company has to regain trust and overhaul its balance sheet. No wonder they’re having trouble filling their CEO spot.

Moving on to some central bank commentary…

One of the biggest bull cases for stocks over the past 12 months has been the Fed “pivot.” First, investors were looking for the Fed to stop raising interest rates. They got their wish last September, when the Fed didn’t raise interest rates for the first time since March 2022.

Since the pause, the S&P 500 is up nearly 25% and is sitting right at all-time highs. Now, folks are already looking forward to rate cuts…

At the start of the year, Wall Street was projecting a handful of rate cuts. But those expectations have come way down. Now, according to CME FedWatch, the market sees about two rate cuts by the end of the year.

Even the Fed, which saw three cuts in 2024 as recently as March, now only projects one. And that may set investors up for disappointment…

Over the past few days, multiple Fed presidents have spoken about their view of the path of interest rates.

First, Minneapolis Fed president Neel Kashkari said one cut in December would be a “reasonable prediction.” Then, Philadelphia Fed president Patrick Harker said one cut by the end of the year would be appropriate, as long as inflation continues to come back down to earth.

That hasn’t happened just yet. Personal Consumption Expenditures (“PCE”), the Fed’s preferred inflation gauge rise 2.8% in April. So it’s still above their inflation target of 2%.

Investors may be waiting longer than they imagine for rate cuts. That hasn’t stopped markets from heading higher. But at some point, the effects of higher interest rates will start to sting.

But volatility is nowhere to be found…

The market’s “fear gauge” isn’t showing much fear these days. The CBOE Volatility Index, better known as the “VIX,” hit a five-year low of 12 last week. That means investors aren’t rushing out to purchase options to protect their portfolios.

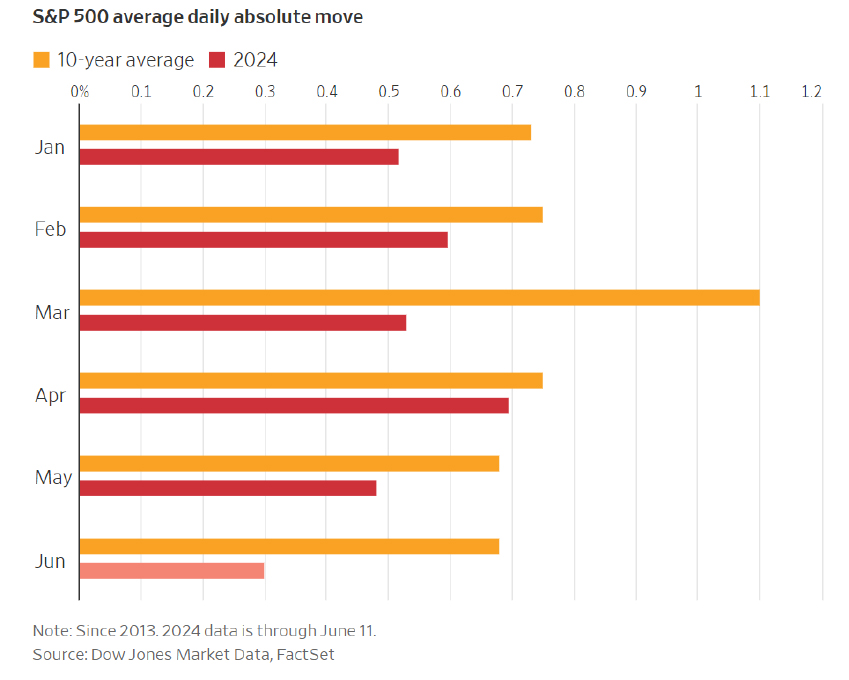

That’s not the only sign of calm waters. Just take a look at this chart from the Wall Street Journal…

This chart breaks down the average daily move for the S&P 500. As you can see, the average daily move in 2024 has been well below the 10-year average in every month except April. And so far in June, the average daily move is half of the historical norm.

Simply put, the markets are boring right now. There aren’t many catalysts that would send stocks immediately higher or lower. (That’s not to say there are no reasons to be bullish or no warning signs).

Don’t get used to it, though…

Our colleague Dr. David “Doc” Eifrig has also seen first-hand the impact of lower volatility on markets. In his Retirement Trader and Advanced Options newsletters, Doc helps subscribers earn income in their portfolio by selling options.

Options trading works best when the VIX is higher. When the VIX spikes, investors are purchasing protection for their portfolios. That means options sellers can collect higher premiums.

Even in today’s low-volatility environment, Doc’s team has produced a steady stream of winning trades. And the next few months could bring even more winners…

In today’s MarketWise Daily, adapted from a recent issue of Retirement Trader[1], Doc explains why we could see a lot more volatility in the coming months. In short, election years produce more volatility the closer you get to the election. As Doc writes…

A close election and delays in mail-in ballots could result in days or weeks without a clear winner. If that’s the case, the markets could get unstable. We could see massive protests in the streets… or worse.

That’s a great news for options sellers. Doc explains that it’s easier to find more lucrative opportunities in the options market when volatility spikes. And he expects to earn record profits for his Retirement Trader subscribers this year as a result.

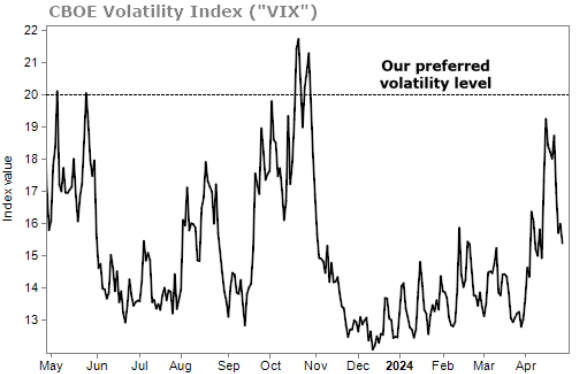

Be Prepared for More VolatilityWe dedicate an entire section of Retirement Trader to market volatility in the second issue of every month. We use the CBOE Volatility Index (“VIX”) as our gauge. The VIX measures the market’s expectation for volatility for the upcoming month by looking at how much folks will pay for protection. When they are worried and expecting price swings, the index rises… along with the prices of the options we sell. Over the past 12 months, we haven’t seen much fear in the market. Stocks are rising and new technologies like artificial intelligence are keeping corporate profits high. We get our best results when the VIX is above 20. Over the past year, it has averaged about 15 and rarely budged past 20. Take a look…

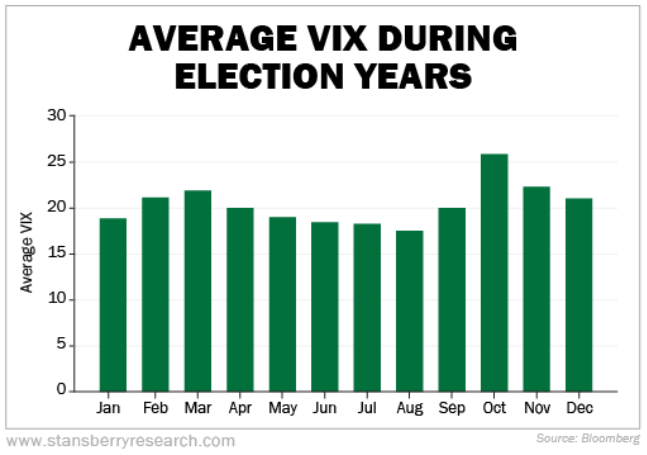

As an example, say a stock is trading for $100. If you sell one contract of an at-the-money two-month put, you’ll collect $78 more when volatility is at 20 compared to 15. During periods of low volatility like this past year, we can always find our own fear” and sell options profitably on individual stocks that the market is worried about. But it’s easier, and more lucrative, when the VIX is higher across the whole market. That’s exactly what we predict for later this year. And it’s all thanks to politics. The chart below shows the average VIX during election years since 1992. You’ll see that the average VIX comes in around 20 during election years. And volatility typically spikes right before the election…

We can see why investors get worried before elections. In this year’s event, Trump has proven to be a nontraditional, unpredictable, and polarizing president. On the other hand, many fear Biden for four more years as his age and mental standing come into question. That’s before we even mention folks who disagree with either of the men on policy grounds. Or maybe the concern involves a contested election. A close election and delays in mail-in ballots could result in days or weeks without a clear winner. If that’s the case, the markets could get unstable. We could see massive protests in the streets… or worse. The point of analyzing this election and all the turmoil is to explain why we don’t have to play that game. We don’t know who will win. (At least, our guess isn’t any better than the market’s.) And we don’t know how exactly the market will react. As an option seller, you get to tune all of that out. You can’t sit on the sidelines in fear that one outcome could be worse for the market. The only thing we know and care about is uncertainty. If you manage a pension fund or work at an investment firm trying to make a quarterly number, it could make sense to buy some “portfolio insurance” given the uncertainty of the election. That often means buying protection in the form of options. On the other hand, it’s clear to us that we want to be the ones selling portfolio insurance in the months to come… Thanks to the higher volatility we expect to see over the next few months, we believe we could produce record profits in 2024 from our Retirement Trader strategy. But we won’t wait around for the VIX to rise. |